The ROI of Legal Spend: Calculating Cost and Time Savings

At Brightflag, we talk to dozens of in-house professionals every day. And lately, we’ve noticed a trend. That trend is an increasing focus on the return on investment (ROI) of legal technology.

This focus on ROI aligns with the overall macroeconomic environment, where there is a squeeze on budgets and a desire to maximize the business value received from technology investments.

This trend has led to increased pressure from the finance team for Legal to prove the ROI of new technology purchases.

While this trend puts the squeeze on legal teams, ultimately Finance has a point. New legal tech should create concrete value for your business, and lots of it. Otherwise, it’s simply not worth your time and your company’s money to purchase the tool.

Calculating the Value of Your Legal Tech Investment

Although the focus on ROI makes good business sense, it does have consequences for in-house teams looking to make their next tech purchase.

The upshot is, if you’ve been thinking about making a new legal tech purchase, you will very likely need to show a clear ROI to get your purchase approved. And that ROI may be scrutinized more closely by Finance than it has been previously.

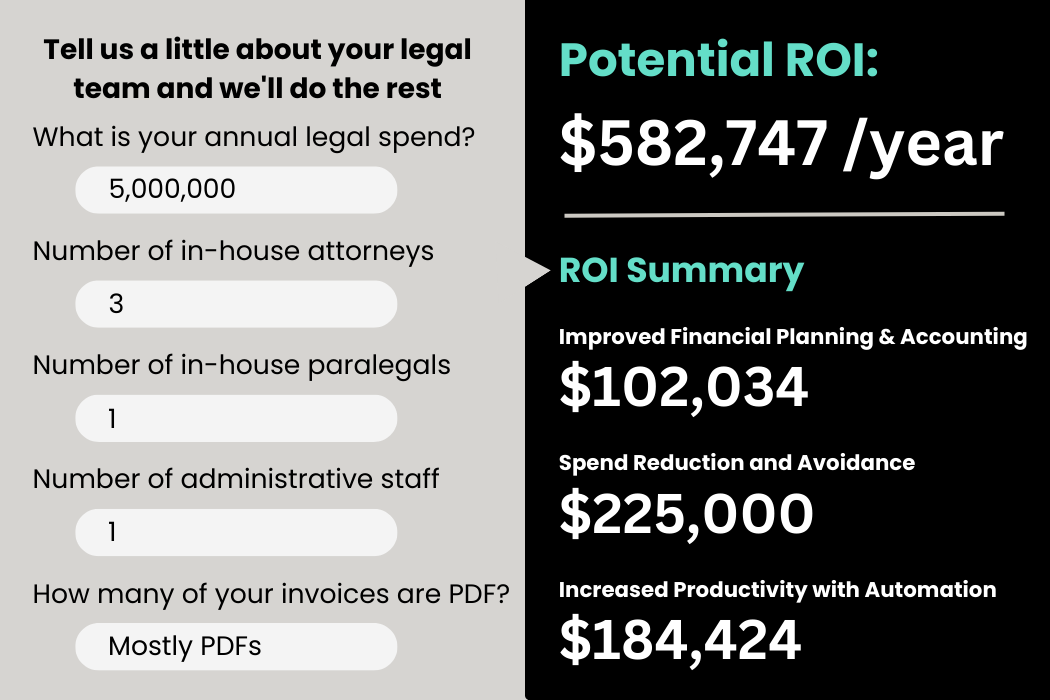

That’s why we launched our new ROI calculator, which demonstrates all the ways that in-house teams save with a modern e-billing and matter management solution like Brightflag.

In this blog, we’ll cover how Brightflag provides ROI for legal teams and for their businesses. We’ll also show what that ROI means for your company’s bottom line, in dollars and cents.

We hope this will inspire you to understand how legal tech tools generate ROI, and that it’ll equip you for when you inevitably get the question from Finance: ‘We get that you want this new tool, but what’s the ROI?’

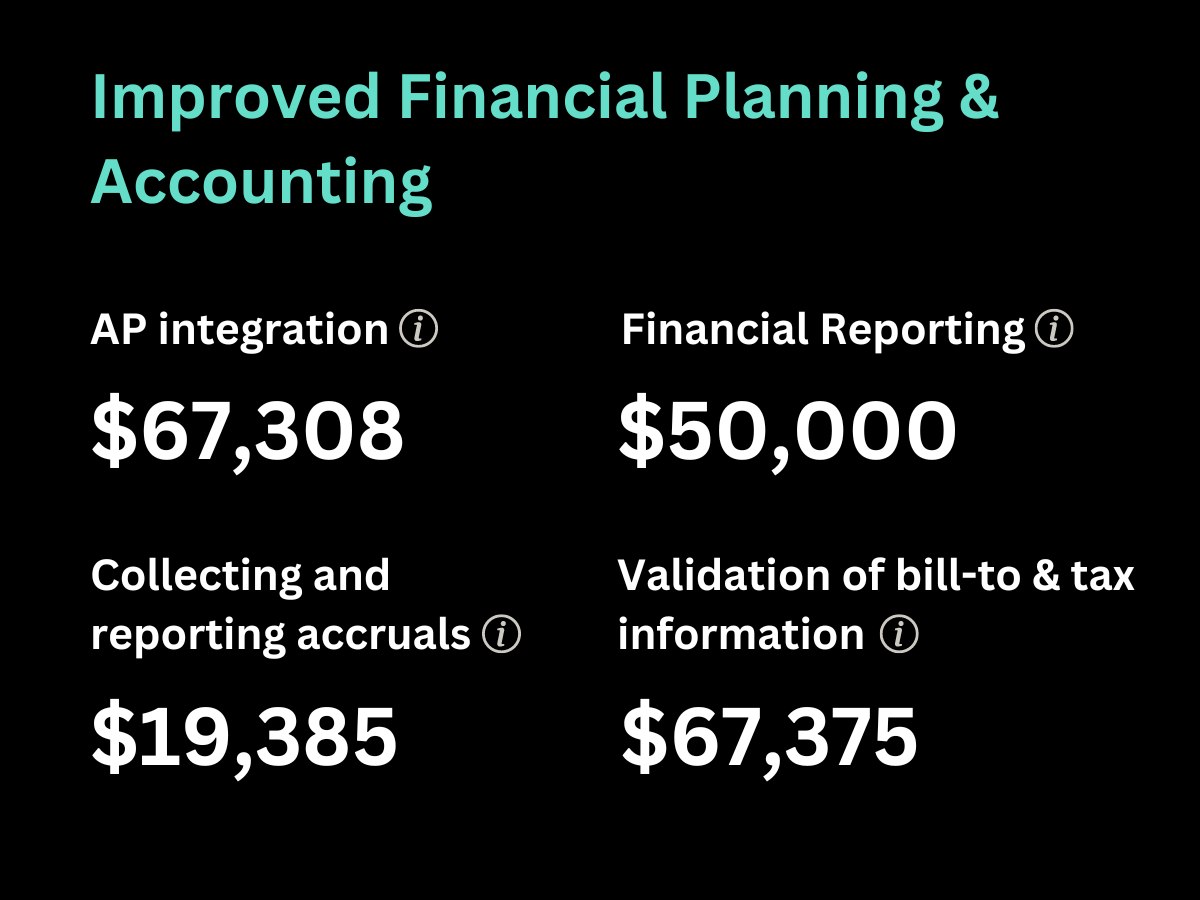

Brightflag ROI Benefit #1: Improved Financial Planning and Accounting

The most important thing an e-billing system can do is give the legal team complete control over their finances.

This is no mean feat. The majority of legal teams today struggle with the financial aspects of outside counsel management, such as knowing what their external spend is, getting invoices approved and paid, and collecting accruals.

Getting your finances in order with a legal e-billing tool like Brightflag allows you to cut through the chaos of billing, and to always know where you stand on spend to budget.

Not only that, it will greatly improve your relationship with Finance, as you’ll be saving them time and countless headaches trying to get a handle on legal spend. And it never hurts to be best buds with the department that holds the purse strings.

In terms of the dollars improved financial management saves your business, these come from:

- Time saved by Legal and Finance due to automated payment, tracking, and communication on payment status.

- Opportunities for savings identified through easy financial reporting, such as reducing spend on over-budget or high-spend matters

- Time saved by Legal and Finance collecting and reporting on accruals

- Time saved manually validating bill-to and tax information on invoices

Here’s an example of how much a legal department spending $10 million on outside counsel a year can save due to improved financial planning and accounting with Brightflag:

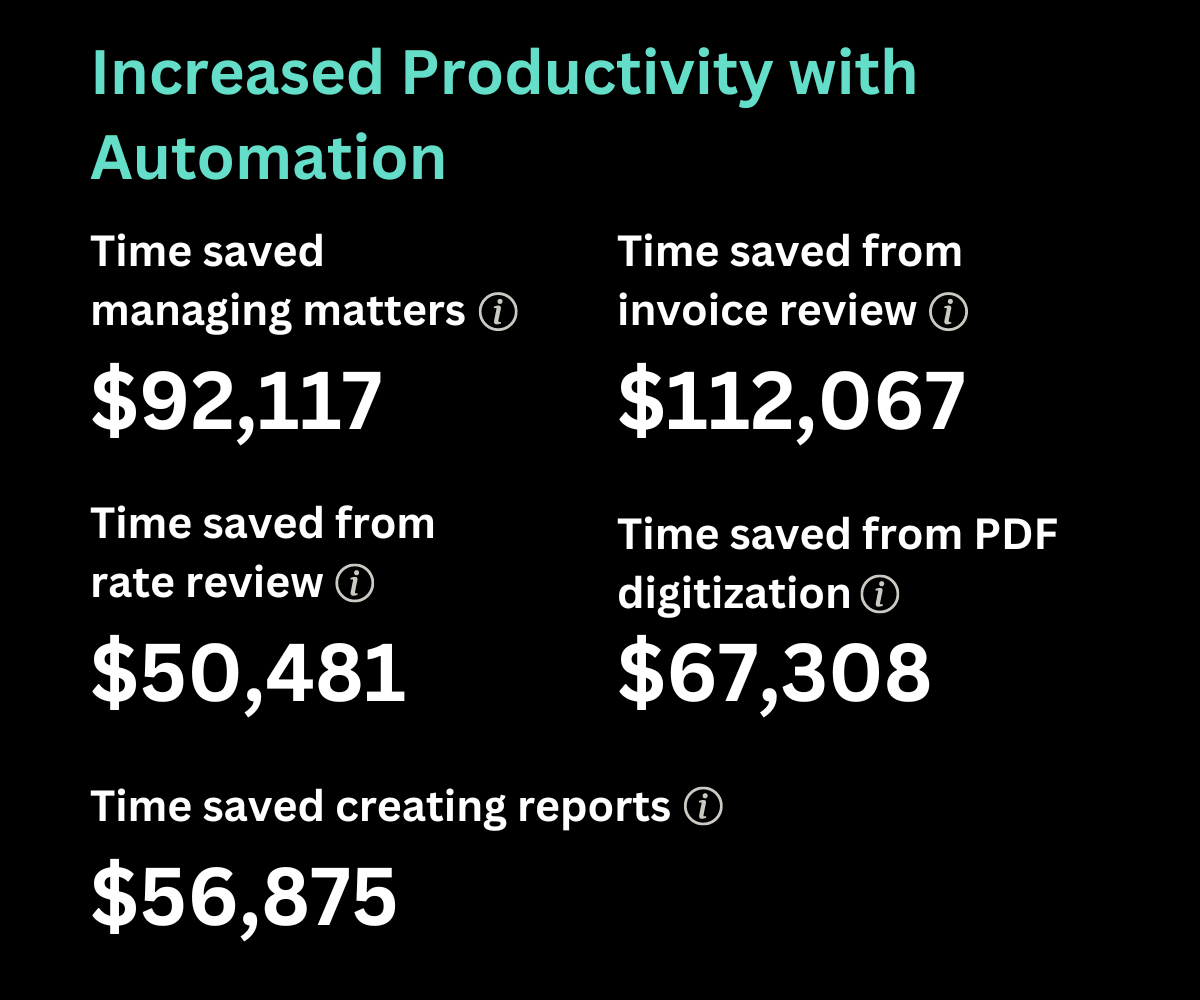

Brightflag ROI Benefit #2: Increased Productivity with Automation

I’ll skip the clichés of ‘doing more with less’, but the reality is still that we are all tight on time, and widespread layoffs and frozen hiring certainly do not help this reality.

All this means that in-house teams simply do not have the time to struggle with inefficient invoicing, matter setup, and financial reporting. There are dozens of more important things any one attorney or ops professional could be focusing on.

A good e-billing system puts time back in your team’s day. Not only does this have a hard dollar saving in terms of the hours saved working on unproductive tasks, but think about the value you can provide to your company by freeing up that time to focus on strategic work.

The monetary value of time savings from an e-billing system like Brightflag comes from the following sources:

- In-house attorneys save time:

- Opening, searching for, reviewing, and updating matters

- Reviewing and approving invoices

- Reviewing and approving timekeeper rates

- Creating reports

- Searching for information related to PDF invoices

- In addition, operational staff save time creating reports

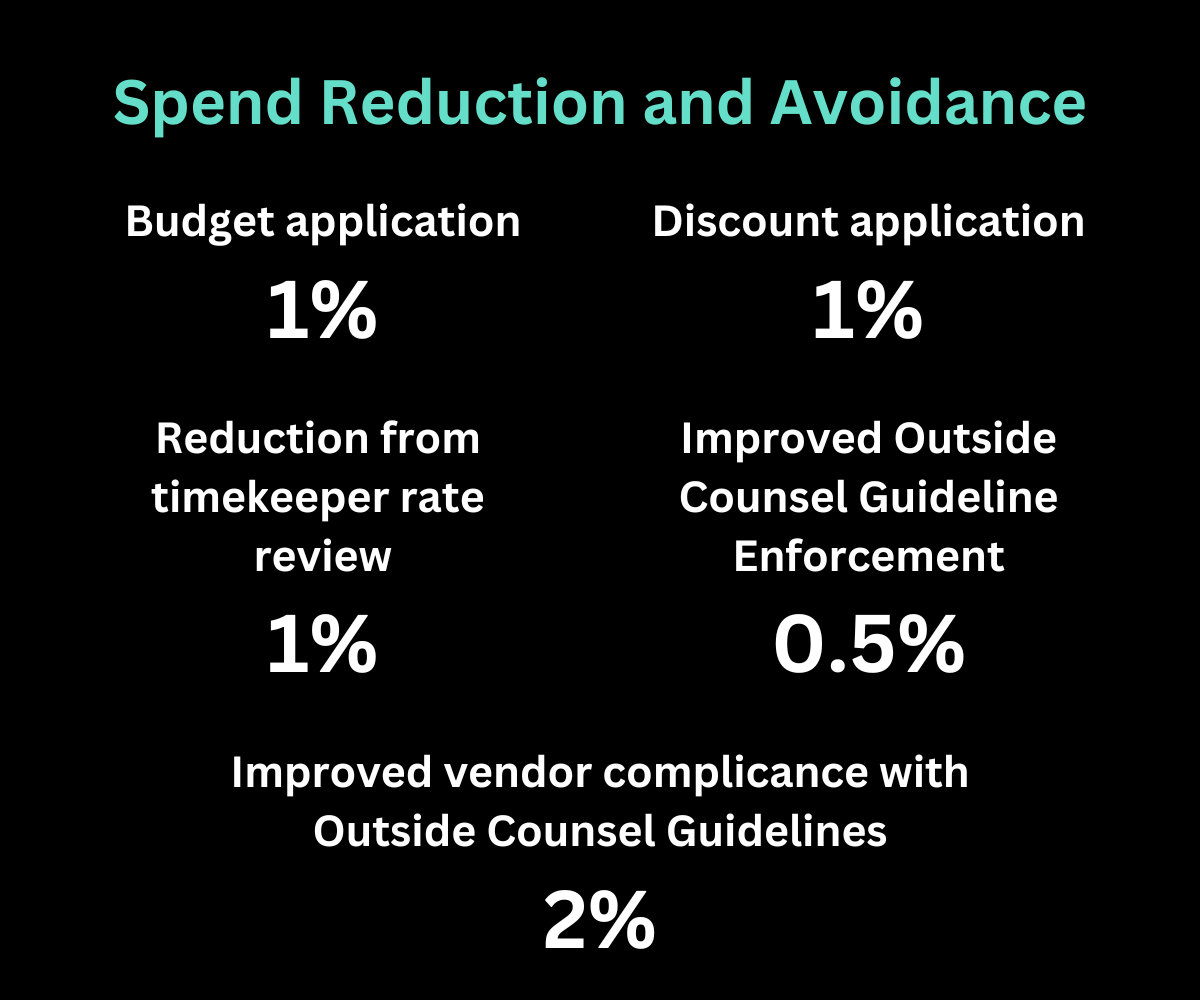

Brightflag ROI Benefit #3: Spend Reduction and Avoidance

A good e-billing system not only provides you with complete confidence in your financial management of the legal department.

A good e-billing system also points to ways in which you can save money, allowing you to tighten your budget, or redirect your budget into high-impact projects that wouldn’t otherwise get funded.

Brightflag helps legal teams reduce and avoid spend by:

- Enabling consistent budget application

- Verifying that discounts are applied correctly

- Improving Outside Counsel Guideline enforcement through AI-powered invoice review

- Improving vendor compliance with Outside Counsel Guidelines over time, as vendors adapt to the AI-powered invoice review process and adjust their billing behavior

- Reductions in timekeeper rates achieved by a good rate review process

Calculating Your Legal Tech ROI

Equipped with the right data, conversations about the ROI of legal technology don’t have to be so challenging. In fact, the increased pressure to prove ROI helps us all truly focus on ensuring legal technology provides real value to the business.

I hope I’ve inspired you to see how a legal tech tool like Brightflag not only provides intangible benefits to your legal team, but also provides quantifiable dollar savings that can help speak Finance’s language and build a solid business case. Check out our ROI Calculator to start saving with Brightflag today.