Legal Invoice Review: How To Do It Effectively

Let’s face it, no one likes reviewing invoices.

As a member of the in-house counsel team, you likely know this all too well. You’re probably either a reluctant invoice reviewer, or it’s your job to chase reluctant reviewers to approve invoices.

As a provider of modern e-billing and matter management software, we understand. In-house team members all have about a dozen more important things to do at any one time than reviewing invoices.

But here’s the thing, money is the language of business. And for legal to be seen as a creator and protector of business value within your organization, your general counsel and legal team have to be effective stewards of your company’s finances. So paying large sums for invoices that have not been thoroughly reviewed doesn’t cut it.

But how can you review invoices effectively and guard your organization against overspending while making the best use of your limited time?

Use Outside Counsel Guidelines to Align Expectations

Performing a truly effective invoice review starts well before an invoice hits your desk. That’s because all good reviews are based upon a solid set of outside counsel guidelines.

Outside counsel guidelines (OCGs), also referred to as billing guidelines, are a tool for aligning expectations between in-house teams and their legal service providers. Outside counsel are expected to adhere to OCGs when performing work and billing on matters.

OCGs typically prohibit work that should be included in the overhead of the firm or that does not add value to your business. Types of work that are usually prohibited in OCGs include:

- Administrative work

- Time spent ‘reading in’ or getting up to speed with a matter

- Time devoted to training junior lawyers

In addition, OCGs specify the kinds of work outside counsel should seek approval for before performing, such as research.

A solid set of outside counsel guidelines help prevent time-consuming invoice reviews by informing your outside counsel upfront of the items that you do not consider billable. Armed with this information, outside counsel can exclude this work from your invoices in the first instance, preventing the need for queries, invoice adjustments, and revisions down the line. You can view a set of sample Outside Counsel Guidelines here.

But that’s only the start of the value of a good set of guidelines.

Use A.I.-backed, Legal e-Billing Technology to Do the Heavy Lifting

In the era of A.I., it does not make sense for every invoice to go through an intensive, line-by-line review by a member of your team.

Take Brightflag for example. Armed with your outside counsel guidelines, our A.I.-powered e-billing and matter management solution can read and understand the work performed on each of your invoices, check for violations of your guidelines, and flag these for the attention of the invoice reviewer.

That means you don’t have to go trawling through pages and pages of an invoice to assess the work performed. Instead, the potentially problematic charges are immediately made visible for your review.

And to make things better, Brightflag can fully automate the review of invoices within certain thresholds.

Are there certain kinds of work you don’t want to pay for in any circumstances, such as printing charges and line items with insufficient detail to assess the work performed? No problem. Brightflag automatically sends invoices with those issues back to your outside counsel to correct, without the invoice even hitting your queue.

And what about invoices that are totally compliant with your outside counsel guidelines? Brightflag automatically approves those, within agreed thresholds. Most of our clients use automatic invoice approval rules for invoices under $5,000 that do not contain any outside counsel guideline breaches. Invoices over $5,000 always go to the relevant team member for review, even if no breaches of outside counsel guidelines are found.

The 3 Steps of an Effective Legal Invoice Review

Let’s imagine you have an invoice that you need to review.

If you have an e-billing system that does the heavy lifting for you, you will only need to review invoices that have been flagged as non-compliant with your outside counsel guidelines, or that have been billed for a high dollar amount.

If you don’t have a system in place today, you’ll have to review without the benefit of automation and flags.

We’ll talk through both scenarios below.

Step 1. Check High-Level Details

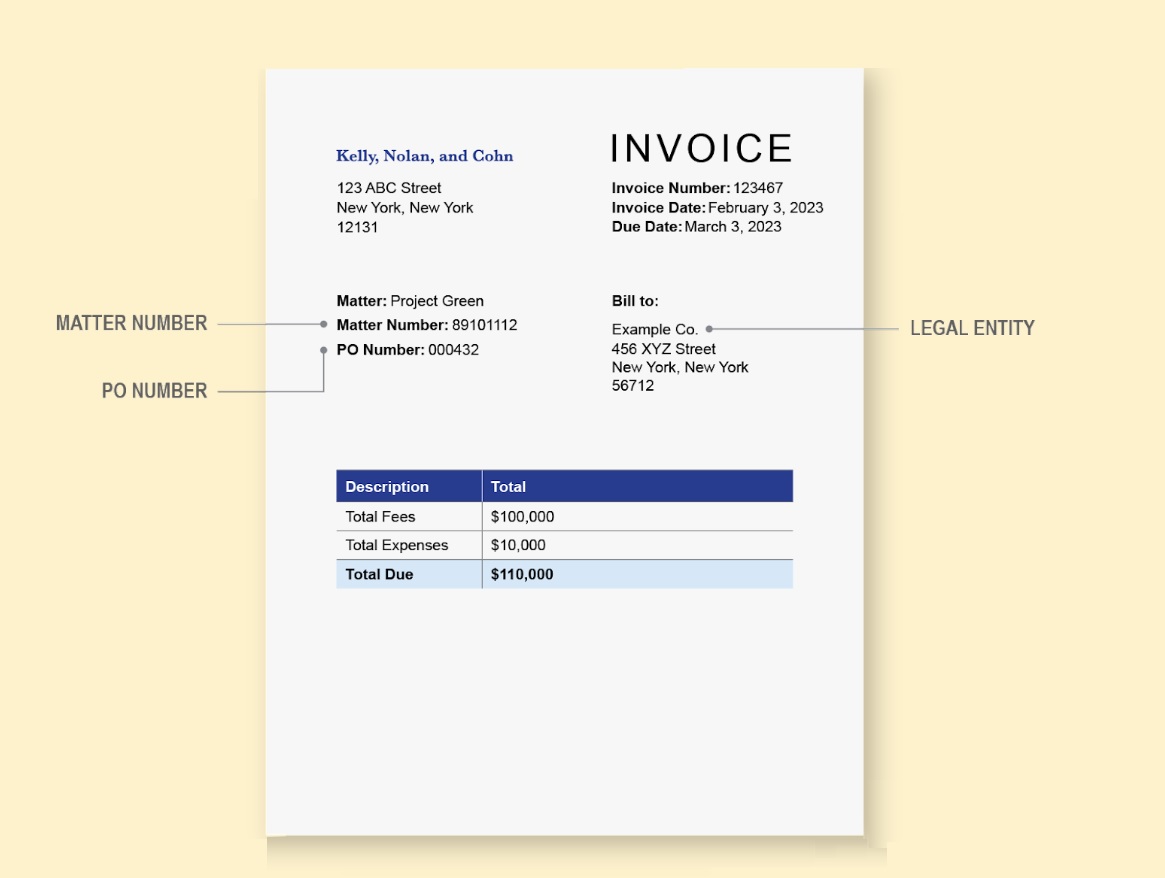

Before getting into the meat and potatoes of reviewing, you need to ensure that the top-level invoice details are correct.

It’s important to ensure that the following details are correctly specified on each invoice and that there are no discrepancies:

- The matter, or project, name

- The legal entity the work is being billed to (e.g. Acme Inc., or Acme UK Ltd.)

- The purchase order (PO) number the work relates to, if your company uses POs for legal work

If any of the above details are incorrect, you run the risk of the invoice being rejected by finance, creating extra work for you, your finance team, and your outside counsel—and delaying payment processing.

In addition to these high-level invoice details, it’s important to ensure that you are the right person to review this invoice. You might need to review this invoice because you instructed outside counsel to perform the work, or because you are a second-level approver who must perform a detailed review all invoices over a certain dollar amount.

It’s common for companies without a legal e-billing system to send invoices for approval to the wrong reviewer, so it’s better to double-check that it belongs in your queue before doing any extra review work—and extending the invoice approval process.

Thankfully, all of these checks can be automated. Brightflag uses intelligent validation features to ensure all high-level details are correct on each invoice. Then, automated workflows are used to route invoices to the correct reviewer.

The final high-level detail to check is the invoice amount. Often, a gut feeling should help you determine if the invoice total aligns with the scope of work you requested your outside counsel to perform. If the final invoice total is significantly higher than you expected, this is a signal that you need to perform a more in-depth review.

Step 2. Consider Spend to Budget

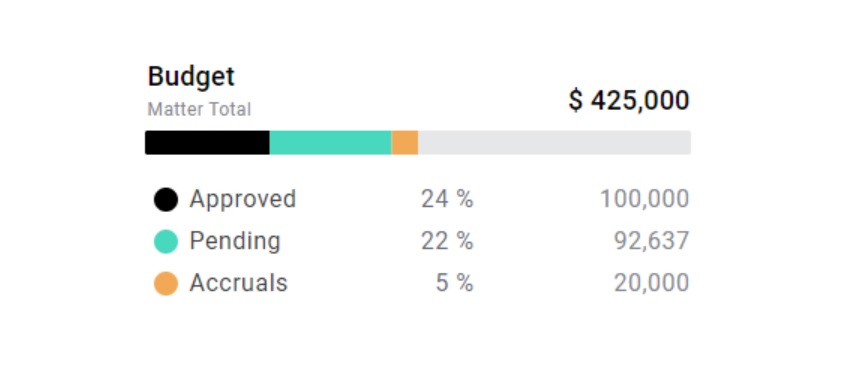

Although we’re talking about invoice review, it’s essential to consider the wider context of the invoice and the effect it has on spend to budget.

It’s best practice to set a budget for every legal matter, excluding those that are billed using agreed fixed fees. However, don’t worry if you’re not doing so today. You’re certainly not alone.

If you have set a budget for the matter the invoice relates to, consider whether this invoice pushes the matter over budget.

Again, technology can help by flagging when the matter budget is exceeded and by automatically rejecting over-budget invoices.

When an invoice pushes a matter over budget, or comes close to doing so, it’s time to re-assess your resourcing plan. Has the matter ended up requiring more work than initially anticipated? Or has there been a misalignment on scope with your outside counsel? Take the time to have those strategic conversations and to course-correct.

Even if you don’t set budgets on individual matters, you still have an overall legal department budget: every in-house counsel team does. So when particularly large invoices come in, consider their impact on overall spend to budget and have the same strategic conversations about resourcing and scope.

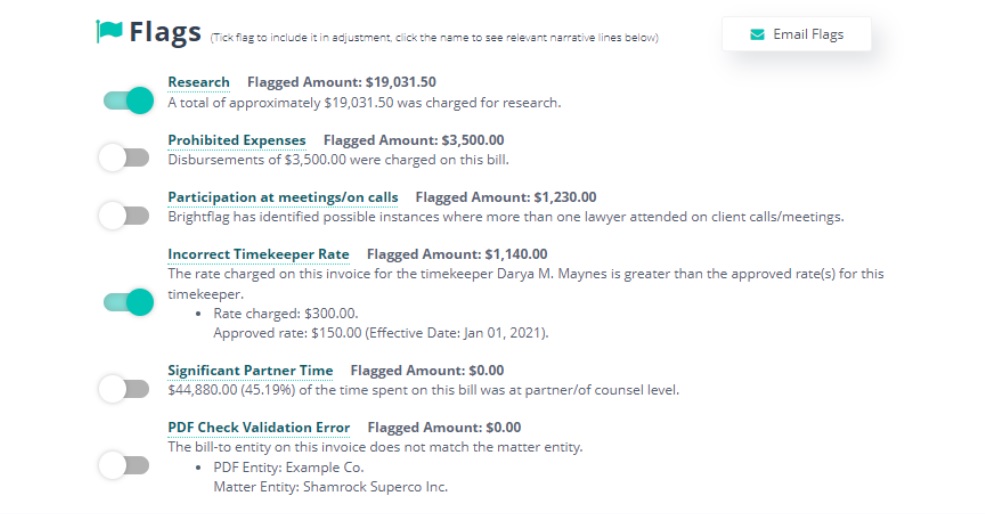

Step 3. Check for Non-Compliant Work

If it looks like the top-level details on your invoice are correct and the matter is within budget, you then need to make sure your outside counsel performed the work as agreed.

If you’re using an intelligent e-billing system like Brightflag, it will automatically check whether the billed work is in compliance with your outside counsel guidelines, and will flag potentially non-compliant work for your attention. To adjust the invoice to remove this work, you simply need to toggle the flags and click approve.

If you are checking the invoice manually, you will need to review line-by-line and query any non-compliant charges with your outside counsel via email.

How to Level Up Your Legal Invoice Review Process

You’ve successfully reviewed an invoice! But you can rest assured that there’s plenty more where that came from. So keep these legal invoice review best practices in mind for the next time one crosses your desk.

And if you feel like you’re drowning in manual review and paperwork, maybe it’s time to see how Brightflag can introduce some automation to the invoice review process to save your in-house legal team time and money, and streamline your workflows. Book a demo today to learn more.