What is Block Billing? (And Why You Should Avoid It)

Long, flowery narratives are great for novels—not for legal invoices. That’s why consolidating multiple tasks and their hours into a single timesheet entry, also known as block billing, can make an outside counsel invoice unnecessarily lengthy and difficult to review.

Block billing makes invoice review—already one of the in-house team’s more time-consuming and less desirable tasks—even harder. It can also make it more difficult to understand legal spend on your matters. Fortunately, you can dissuade vendors from block billing and get better control over legal spend with strong outside counsel guidelines and legal spend management software.

What is Block Billing?

Block billing is the practice of including an entire block of time in one legal invoice line item, along with an itemized list of the tasks completed during that block. These billing entries are often long and include tasks that span multiple UTBMS codes but don’t explain how long was spent on each task.

For legal billing, it’s best practice for timekeepers to itemize each specific task they performed on your matter in individual line items with time accounted for each task. Traditional LEDES invoices reflect this expectation, by requiring one UTBMS activity code and one task code per line. When billers itemize line items correctly, reviewers can quickly see what work was done and the time it took to do that task.

Example of Block Billing

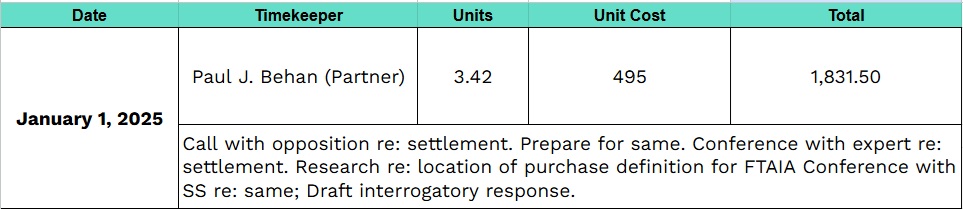

Some red flags of block billing include a narrative with several different tasks that encompass a significant amount of time—typically several hours.

In the example above, the vendor describes a series of different tasks that totaled 3.42 hours, but when the in-house team does a manual invoice review, it’s impossible to tell how much actual time each individual task took.

The tasks in this narrative include preparing for the phone call with the opposition about the settlement, researching a different part of the matter, and drafting a response. Following billing best practices, each of these tasks should be split it onto their own invoice line item. However, this line item has been block-billed and includes all of these tasks in one line item.

Why Block Billing Is Considered Bad Billing Hygiene

Block billing makes it harder to understand your legal spend. It also makes it more difficult for in-house legal departments to review invoices.

In an invoice with block billing, reviewers cannot see how much time it took to perform each task. In addition, multiple tasks are sandwiched into one long description. So, work that does not align with your outside counsel guidelines could slip through a manual review.

Not only do block-billed lines complicate the manual review process, but they also make it easy to over-apportion time and costs to certain UTBMS task codes, obfuscating the true cost of a matter stage.

Brightflag analyzed the most commonly used task codes on legal invoices. During their review, they found frequent overuse of the L120 task code for strategy and research. Some costs tagged as L120 were actually pre-trial and discovery, making the true costs of each stage of the matter difficult to assess.

The Negative Impact of Block Billing on Legal Spend Management

Because of the lack of transparency, block billing makes invoices more difficult to process and can strain the client-vendor relationship. Here are five ways block billing can negatively impact legal spend management.

Violates Billing Guidelines

If you are like most in-house legal teams, your outside counsel guidelines prohibit block billing. Submitting a line item invoice with block billing would be a clear violation and should be rejected. Repeated rejections cause more work for your team to review each invoice multiple times, hampering the relationship with that vendor.

Impedes Cost Control

Without the clarity of individual line item billing, it can be difficult to understand the true costs associated with a matter. Legal ops may find it harder to identify areas for improvement and resourcing optimization.

Block billing can also leave room for accidental inflated billing. For your outside counsel, combining several tasks in one narrative may take less time than itemizing each task. The lawyer knows they spent four hours today working on various items for your team, but breaking it down by task will take longer than just listing what they accomplished. However, the lawyer may log too much time for one of the tasks or inadvertently double bill for the same work. If this happens repeatedly, it can affect your relationship with that vendor.

Delays Payments

It takes longer to process an invoice with block billing because the invoice review has to be more detailed. That’s assuming the client didn’t reject the invoice for block billing in the first place. If so, it would need to be resubmitted it for yet another review.

Legal Ethics and a Lack of Transparency

Law firms are encouraged to follow certain guidelines set by the ABA Ethics Rules of Professional Conduct, including charging reasonable fees for their billable time. Combining multiple tasks into one line item can raise questions about the reasonableness of what is being charged and for what work, even if it is all legitimate.

In a blog post, Rees Morrison provided a block billing example with a variety of tasks, including drafting an email, legal research, and working on an invalidity claim chart, for a total of 8.7 hours. But unless the particular tasks are broken out, “block billing can make unreasonable amounts of time (3.4 hours for an email on a discrete issue) impossible to detect.”

Detecting and Preventing Issues with Block Billing

While it’s always better if your vendors don’t use block billing, AI-enabled legal spend management tools can help detect and manage it when it occurs.

At Brightflag, our AI-enabled e-billing software can detect block-billed lines automatically. It can understand and flag when a line item contains multiple activities. With this functionality, customers can automatically reject block-billed line items or pay those items at a discounted rate due to the block billing.

When lines are block-billed, Brightflag also goes further than the standard LEDES format by apportioning multiple UTBMS codes to one line, splitting the time spend per task code for a more accurate view of costs.

Amy Drury, Senior Intellectual Property Paralegal at Dropbox, saw how the AI-enabled tools simplified invoice review when they implemented Brightflag. “Invoice review and opening matters is really quick, which is a huge win for our lawyers in particular. We have also seen significant invoice write-downs in areas where vendors were not complying with the agreed billing guidelines,” she said.

Want to see how Brightflag’s spend management tools with AI can save your team time and reduce legal spend? Sign up for a demo.