Does Your Accounts Payable System Serve Your Legal Spend Management Goals?

In-house legal teams, like every other business department, need to plan, report, and strategically control costs.

The best method for satisfying that mission, however, is up for debate.

Corporate finance teams tend to believe that standard accounts payable (AP) software is more than sufficient for managing legal spend. After all, they’ve seen it work across every other context. Why can’t lawyers conform?

But the trouble isn’t legal people, it’s legal services. The work itself demands a fundamentally different set of procurement and delivery practices.

These sector-specific nuances were never factored into the original design of AP systems. On the contrary, standardization across business units was the intended outcome.

This dynamic has left many corporate legal departments pressing square pegs into round holes. And with so few making progress on their cost control goals, it’s worth asking whether the task requires a more specialized tool.

The Challenges of Corporate Legal Spend

Companies can and should manage legal spend as rigorously as any other business expense. It’s a worthy and realistic ambition. But those hoping to win must first acknowledge the difficulty of the game they’re playing.

Hard to Predict Demand

A company’s need for legal expertise is largely determined by the regulations of its industry, the actions of its competitors, and the strategies of its directors. All three are prone to emerge unexpectedly and evolve rapidly.

The inherent sensitivity and urgency of the work also leaves in-house legal teams with little room to refuse demands or delay responses. In the case of litigation proceedings, for example, work must often proceed regardless of its financial implications.

Hard to Define Scope

Once a company confirms the type of legal advice it requires, the details and the duration present additional challenges.

- Which vendor, or firm, should we engage for legal advice?

- How will the work be phased?

- Which activities will add up to an effective strategy?

- How long will it take to resolve the matter?

Each legal project is unique, based on the specific facts at hand. This means that it’s very hard to determine the ideal answer to each of the above questions upfront. But get them wrong, and costs will soon spiral out of control..

Hard to Analyze Activity

Legal invoices are typically billed on an hourly basis, which means they are often long and complex. Invoice reviewers must comb through hundreds of line items across dozens of pages just to confirm the simple facts of who delivered what. (And that’s assuming vendors have accurately portrayed and categorized their work.)

From there, invoice reviewers must compare all these nuanced services against established outside counsel guidelines before deciding to reject or approve charges.

Hard to Assess Value

Outside counsel guidelines help assure cost compliance. Achieving cost efficiency, however, requires an even more sophisticated approach.

- Was the work assigned to the appropriate vendor?

- Did they employ the optimal strategy?

- Was the result worth the money?

Companies ultimately need a critical mass of comparison points before they can begin to answer these higher-order questions. And even then, it takes an expert’s eye to evaluate the evidence.

Where Accounts Payable Systems Excel

AP systems are a corporate fixture for good reason. They reinforce the rules, accelerate the processes, and generate the reports that define basic business accounting.

Purchase Order Creation

Before work begins, AP systems help confirm exactly what goods or services the company plans to purchase from a vendor. Details of the planned transaction are typically captured in a purchase order (PO).

Vendor Invoicing

Once goods and services are delivered, AP systems serve as the inbox for vendor invoices. The software compares each invoice against its corresponding PO and accepts or rejects the expenses accordingly.

Transaction Reporting

After invoices are approved, AP systems update the vendor record to reflect the latest transaction. Companies can then task the software with running reports that sort their combined spend by vendor or departmental allocation.

Where Accounts Payable Systems Struggle When Tracking Legal Spend

The workflows described above are great for governing most business expenses. But the unconventional traits of legal services place a unique strain on AP systems.

Difficulty Forecasting Changing Workflows

Before work begins, the rigidity of PO requirements typically conflict with the uncertain scopes of most legal matters. Who can accurately summarize, for example, the planned activities and expenses of a project that could last three months or nine?

Inadequate Reporting for the Purposes of Legal Spend

AP systems tend to report on spend at the invoice, vendor, and cost center level, while for legal services, the atomic unit of spend is the matter, or legal project. The inability to report at the matter level means legal teams lack real visibility into what’s driving spend, and therefore cannot effectively control costs. It also complicates the collection and reporting of accruals. If legal teams can’t collect accruals at the matter level, it becomes very challenging to ensure those accruals are accurate.

Lack of Automation, Customization, and Functionality

Once an invoice arrives, the AP system will be of little help to invoice reviewers, as it does not provide an easy way to review and adjust invoice line items, nor does it provide automatic checking of the line items for outside counsel guideline breaches, agreed timekeeper rates, or budget violations.

Shallow Reporting Capabilities

Finally, once invoices pass through the approval queue, AP systems enable only surface-level financial reporting. Companies are still left pondering questions like:

- How were costs distributed across each matter and practice area?

- Which timekeepers contributed to each task and expense?

- How did timekeeper rates compare to established benchmarks?

These limitations are more than an administrative headache for legal. They’re a financial liability for the company.

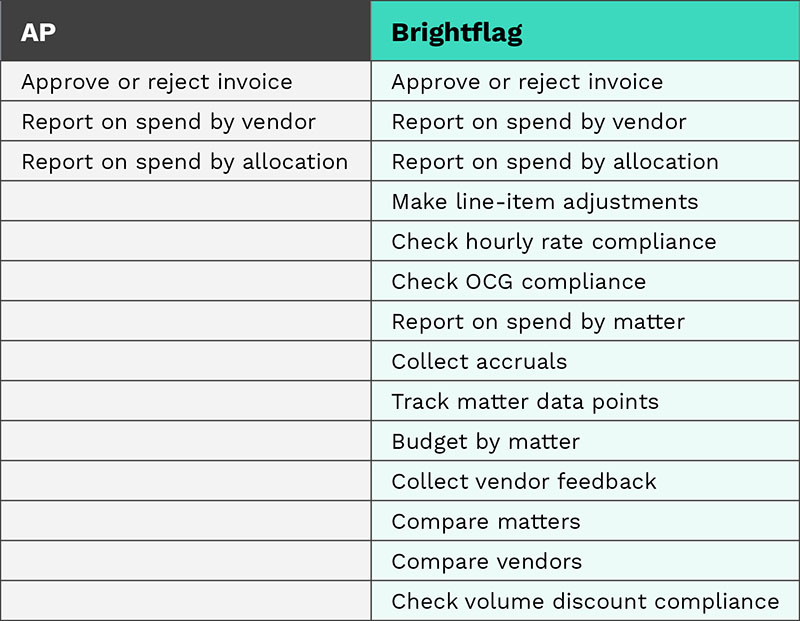

Where Legal Spend Management Software Excels Over Accounts Payable Systems

It’s no surprise that spend management platforms (also called e-billing and matter management systems) are among the most-adopted technologies across corporate legal departments. These specialized solutions offer financial advantages that you don’t need a law degree to appreciate.

Refined Budgeting

Before work begins, legal spend management software helps companies install both top-down (department-level) and bottom-up (matter-level) budgets. This simultaneously clarifies cost expectations for vendors and sharpens forecasts for finance.

Once work begins, the platform empowers clients to collect accruals data at the matter level, and to review the accruals for accuracy.

Automated Invoice Review

At invoice submission, the technology automatically reviews each invoice line item and flags any budget overruns, unauthorized rate changes, and otherwise non-compliant charges. This innovation alone can spare legal department’s hours of manual effort each month—all while saving money.

Advanced Reporting Capabilities

In addition to tracking detailed financial data, legal spend management software also enables companies to identify and mitigate high spending matters and practice areas. And it’s these advanced reporting capabilities that deliver the greatest long-term gains in cost control.

Suddenly companies can derive fast, objective answers to questions like:

- How can we manage work more efficiently for this matter/practice area?

- Which vendors are most cost-effective?

- What hourly rate should I be paying?

Isn’t that the level of confidence every corporate finance team should want for their legal department?

Seamless Integration

To top it off, e-billing and matter management systems integrate seamlessly with AP systems, ensuring that finance get the invoice, accruals, and budget data they need, while legal have all the information they need to confidently control costs.

See the Difference for Yourself

While incredibly useful for tracking expenses in other areas of a business, when it comes to legal spend, an AP system has a difficult time matching the functionality of a dedicated legal spend management platform.

To learn how Brightflag goes beyond AP system basics and gives companies the power to confidently control legal spend, book a demo today.