Reduce Manual Work With Brightflag’s Automated Tax Compliance

Brightflag’s Tax Engine can:

- Process unique invoice approval workflows around the world, including North America, Europe, and APAC.

- Itemize the applicable tax jurisdictions, types, and rates on each invoice submitted via PDF or LEDES.

- Automatically ensure the correct tax rates have been applied at the beginning of the invoice submittal process.

- Automatically send the correct tax code to your AP system.

This feature allows users to:

- Significantly reduce the time it takes for invoices to get paid.

- Mitigate the risk of manual errors.

- Significantly reduce the tedious manual input previously required by Finance.

- Demonstrate compliance and be confident that your invoices will never be rejected due to tax reasons.

- Improve the existing relationship between your legal and finance teams.

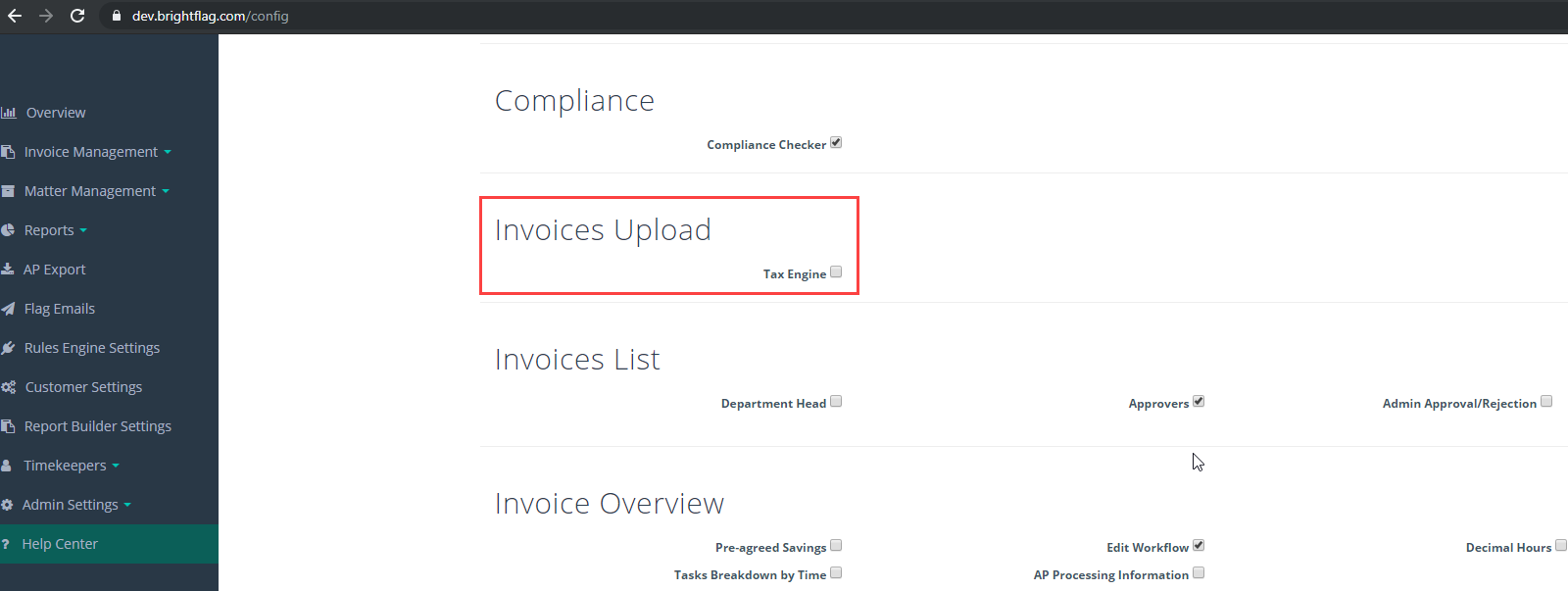

The process for utilizing the Tax Engine is simple:

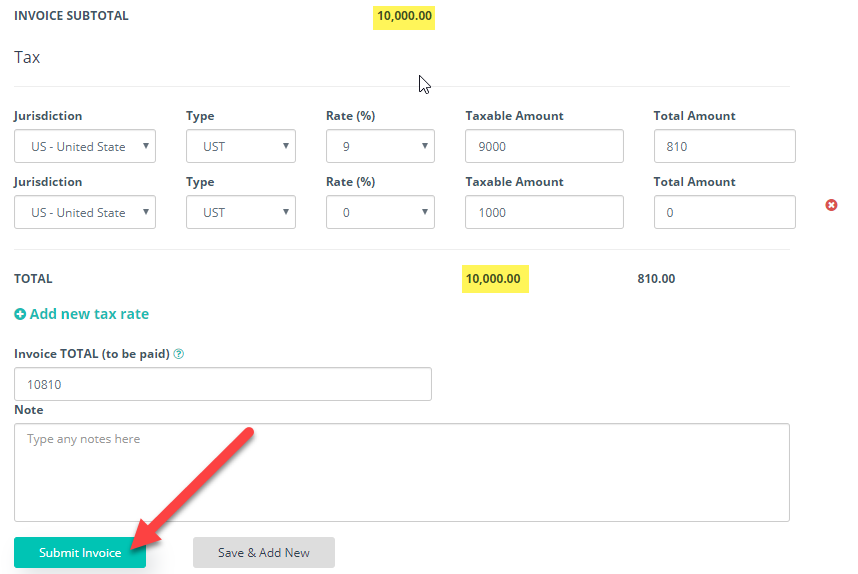

- Your law firm will submit an invoice.

- If the invoice is a PDF, the line-item level tax information will be manually entered. If it’s in LEDES format, the system automatically reads the tax information. Tax entries must be included for every item on the invoice even if there is a 0% tax rate applied.

- The in-house team then reviews and approves your invoice in Brightflag.

- Your invoice goes straight to your AP system for payment.

To learn more, please check out our Help Center article.